If you like scandal and intrigue, this very in-depth article is for you. Here is the intro:

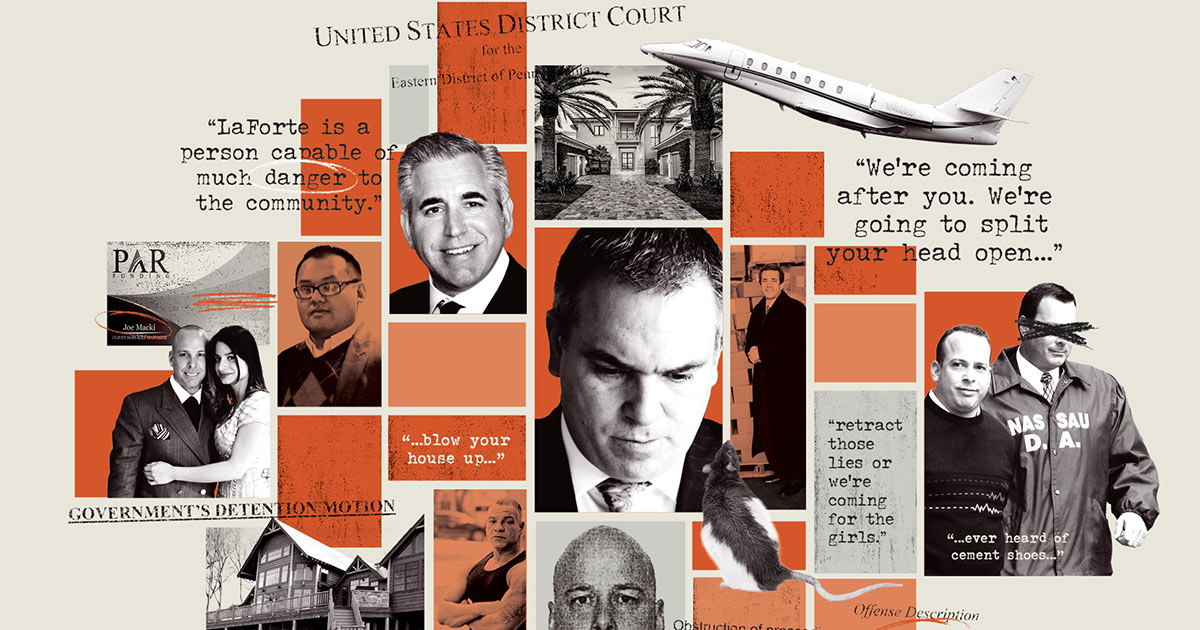

Joseph LaForte and his associates claim they ran a legitimate lending business. The SEC and the Justice Department say it was a massive grift — and one of the biggest financial crimes in Philly history. What everyone can agree on? It’s gotten vicious.

The lure was a free dinner and the promise of returns as high as 14 percent. The key pitch came from Joe LaForte, a two-time felon whose prior financial trickery cost his victims $14 million.

The 300 or so guests in the ballroom of the Sheraton Hotel in King of Prussia on November 21, 2019, didn’t know that. LaForte sold himself as someone with only their best interests in mind.

“Every day we go into the office, we understand there are real lives behind these investments,” LaForte told the gathering. “We really feel strongly about the fact that people are trusting us. You’re putting your trust in our company. And that’s meant a lot to me since day one.”

Moreover, LaForte said, he had put his own money on the line to launch his business, the Philadelphia lender known as Par Funding. “I started the company eight years ago with $500,000 of my own capital,” he said. “And here we are with $434 million in account receivables.”

And he went on: “Just to brag a little about the company, we’re probably the most profitable cash-advance company in the United States — or maybe the world, for that matter, pound for pound.”

Par Funding’s financial model wasn’t complicated. It took in money from investors, touting high returns, and lent that money out at punishing interest rates to smaller merchants who couldn’t get loans from banks. The firm, its executives boasted, delivered great results in a burgeoning trade known as the merchant cash-advance industry.

LaForte, compact and with a signature buzz cut, was just one of a battery of pitchmen wielding microphones that night to sell Par Funding to the assembled middle-class diners. Par executive Perry Abbonizio, with salt-and-pepper hair and a distinguished mien, talked up the firm’s “rigorous operational standards” and how it had the “best underwriting in the industry.” That was why, he said, fewer than one percent of Par Funding’s borrowers defaulted on their loans.

Full story below