"Property mogul Barry Sternlicht last week said there’s $1.2 trillion of real estate losses in offices alone and “nobody knows exactly where it all is.” Investors are growing alarmed that smaller banks might be on the hook for much of the wipeout."

"Concerns mounted over the past two weeks after New York Community Bancorp, under pressure from a US watchdog, slashed its dividend to help stockpile funds in case commercial real estate loans go bad. And property values may have room to fall further, only adding to the pain for lenders: research firm Green Street estimated this week that appraised values of properties may need to drop another 10% to reach fair valuations.

The turmoil is a blow for landlords and bankers who were waiting for lower borrowing costs to ease the pain, embracing the mantra of ‘Survive Til ‘25.’ While that looked a good bet a couple of months ago, the robustness of the economy may cause the Federal Reserve to cut rates at a slower pace than markets had expected, increasing the risk of write downs at smaller lenders after they pushed into commercial real estate lending in recent years.

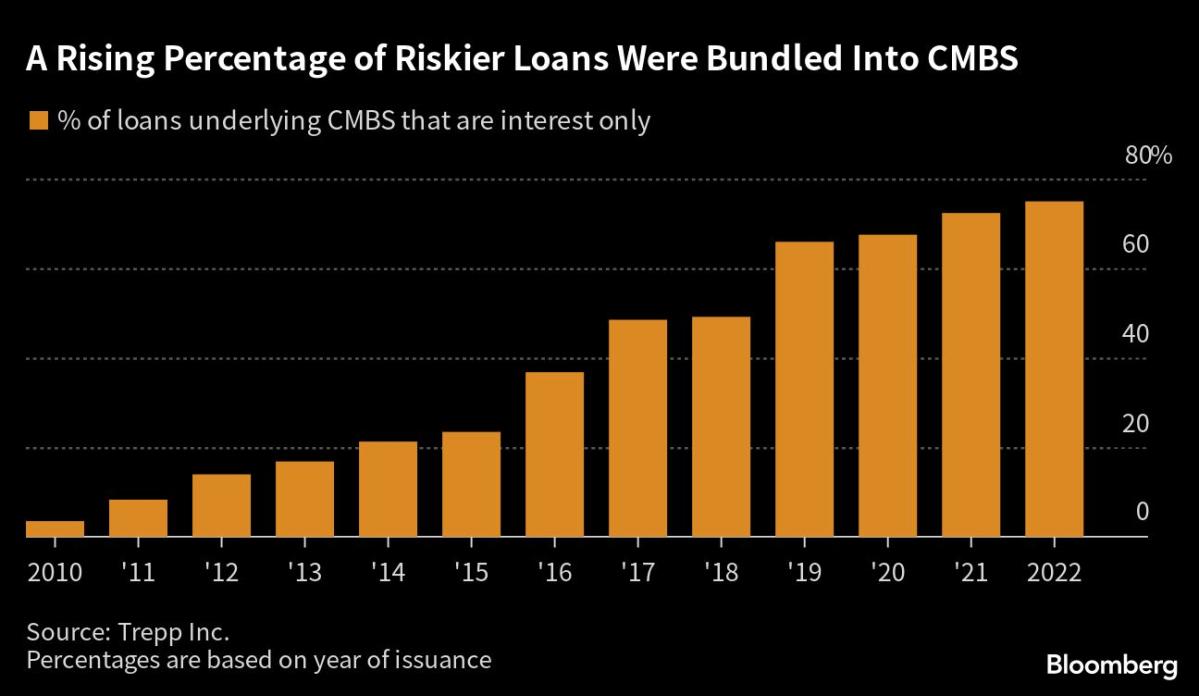

Here are six charts that show where we stand and how we got here:"